Taking a breather

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Last week appeared to calm down, which was a breath of fresh air for financial markets that seem determined to keep the most tranquil investors on the edge of their seats. The VIX index, which measures the expected volatility of the S&P 500 Index, has declined 52% from its monthly high. The MOVE Index, which measures bond market volatility, has declined 24% from its monthly high and is near its 52-week average. The Treasury market reflected mild rate changes across the curve last week.

For day traders, volatility represents an opportunity to outsmart other investors by skillfully determining the opportune moments to enter and exit the financial markets. Those who read this article will tell me I shouldn’t compare investors, but let’s be factual. Every trade has two sides; you are either on the buy or sell side. Time will determine who timed the market better. But I will also go out on a limb and assert that an overwhelming majority of this readership is not day trading or investing solely on total return prospects. I will contend that most of you are likely long-term investors seeking growth and locking in income and cash flow as markets permit.

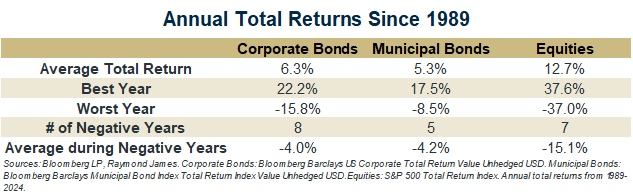

So, what does this mean? Growth assets usually have higher levels of risk and return. Stocks have shown and delivered significant returns for investors over the last two years. The increased volatility and 2025 corrections in the DOW and S&P are reminders that this growth can be met with periods of substantial volatility, including increases and declines. Declines require greater increases to offset each other. For example, a $100 stock that experiences a 10% loss to $90 must have an 11.1% gain to get back to $100 or a 22.22% gain ($90 x 1.222) to net $110 (10% net gain). Over long periods of time, it is hopeful (and likely) that the times of sizeable growth, less the declines, net an investor considerable portfolio growth.

Individual bonds deliver a very different role in the portfolio. Significant capital gains are much less likely, but so are significant capital losses. As a matter of fact, barring an extraordinary event like a default, the only way to lose money when owning individual bonds is to sell them before maturity. The income earned, cash flow stream, and date that the face value is returned do not fluctuate in any way, despite any market volatility or noise. Therefore, individual bonds and their stability present a viable investment for preserving wealth. When investing in high-quality, investment-grade credits, defaults are unlikely, and cash flow and income are predictable. The most challenging part might be disregarding when a statement reflects the changing market price, even though it does not influence performance unless an individual bond is sold before maturity.

The first quarter of 2025 has been a good reminder that investment portfolios benefit from an appropriate blend of growth and preservation assets. The last ~2 years have allowed investors a dual benefit with fixed income. Yields are elevated, thus presenting investors with close to growth-like returns without the same levels of market risk associated with most growth assets. This has been particularly true for investors in the highest federal tax brackets, where tax-equivalent yields on tax-exempt bonds may even exceed long-term growth returns. Regardless of your tax bracket, taking a breather, ignoring the noise, and focusing on long-term strategy will remind you of the overall market opportunities that exist right now.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.